화제의 뉴스

오늘의 이슈픽

인기 영상

가장 많이 본 뉴스

- 1[단독] 배달의민족, 개인 맞춤형 맛집 추천…배달앱...

- 2[집중취재]'한국콜마 사태' 경영권 놓고 '남매의 ...

- 3[크립토인사이트] 인터체인 메시징 프로토콜 레이어제...

- 4증시 오늘 '핫이슈' "'자사주 의무소각' 9월까지...

- 5배드뱅크 내달 설립…10월 매입 개시

- 6한-나이지리아, 디지털 경제 협력…"데이터 주권 확...

- 7증시 오늘 핫이슈…드디어 중국 태양광이 무너졌다, ...

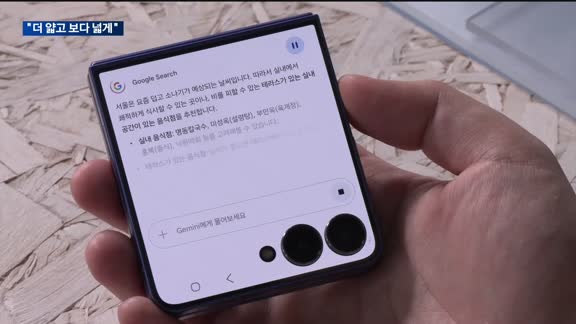

- 8폴더블폰 왕좌 지킨다…삼성, 초슬림 폴더블폰 출격

- 9해양허브도시 부산의 미래, 남부권과 함께 연다…4대...

- 10"경제위기, '남해안 벨트'로 돌파구"…부산연구원·...

투데이 포커스

화제의 뉴스

포토뉴스

![[집중취재]'한국콜마 사태' 경영권 놓고 '남매의 난' 격화](https://imgmm.mbn.co.kr/vod/news/103/2025/07/10/20250710162703_10_103_0_MM1005607019_4_296.jpg)

![[단독] 배달의민족, 개인 맞춤형 맛집 추천…배달앱 경쟁에 싹 바뀐다](https://imgmmw.mbn.co.kr/storage/news/2025/07/11/c72f36b48c06451a8a1548f620cbf487.jpg)